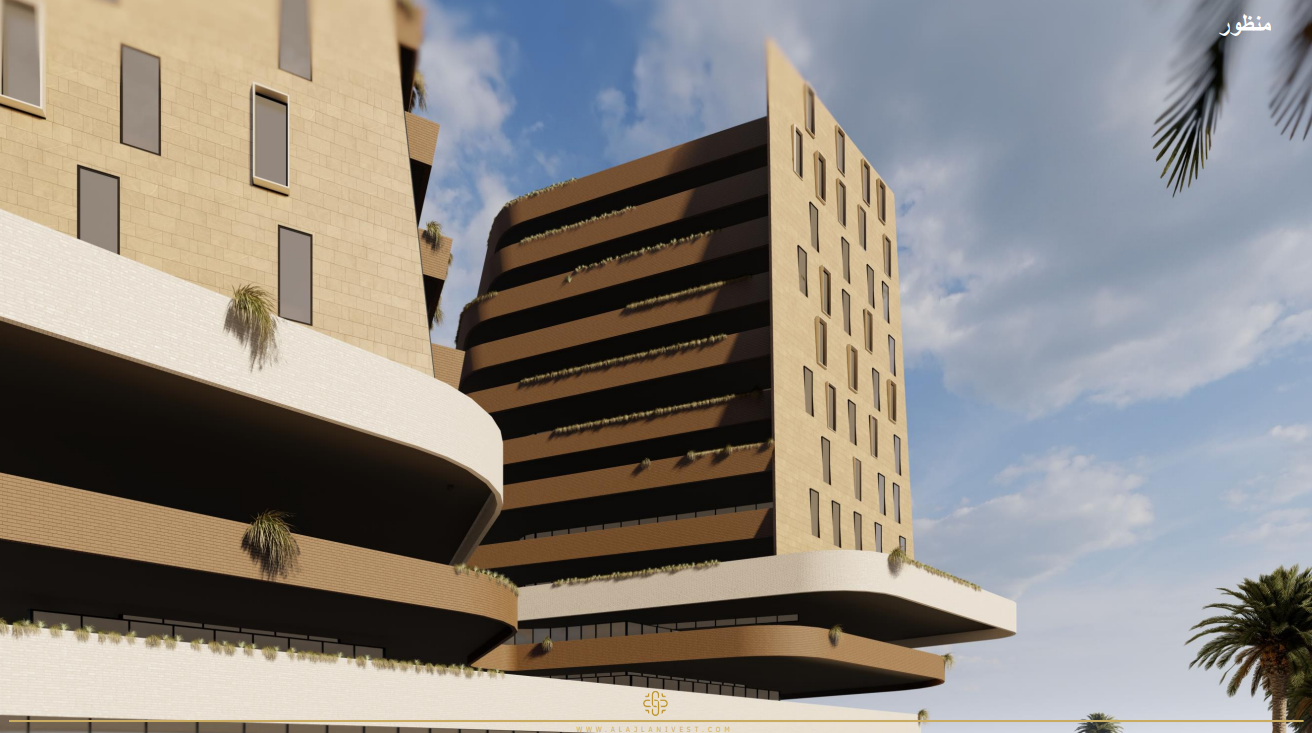

Mulkia – Al Ajlan Riviera Fund 2 is a private closed-end real estate investment fund that complies with the rules and regulations of the Capital Market Authority and the regulatory authorities in the Kingdom of Saudi Arabia and with the controls of Islamic Sharia. It obtained the Authority’s approval for the offering on 11/27/2024. The fund aims to acquire a residential and commercial land located in Riyadh – Al Sulaymaniyah district, in order to develop it in the form of high-end residential towers in order to achieve capital returns by selling real estate assets to those wishing to own residential units.

| Fund Name | Mulkia – Al-Ajlan Rivera fund 2 |

|---|---|

| Fund Manager | Mulkia Investment |

| Fund Currency | Saudi Riyal |

| Fund Type | Private close-end real estate fund |

| Fund Period | Three years, extendable for Three years |

| Unit Price at IPO | 10 SAR |

| Risk Level | High |

| Fund Objectives | Acquiring a mixed-use residential and commercial plot of land located in the city of Riyadh, with the aim of developing the above-ground infrastructure into luxury residential units, and then marketing and selling them to achieve capital returns for the unit holders. |

| Fund Start Date | 15/01/2025 |

· Location of the fund’s land plot: https://maps.app.goo.gl/VEC3JGLbL5cwTMig8

· We are glad to take your questions and inquiries regarding Mulkia Alajlan Riviera Fund 2 on the E-mail of the fund: crm@mulkia.com.sa