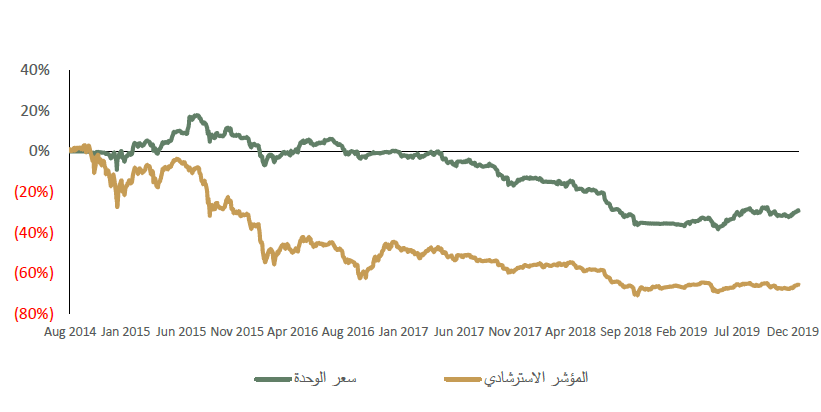

Mulkia IPO Fund is an open-ended fund that aims to achieve medium to long-term capital growth by investing in the Initial Public Offering of securities in the Saudi capital market and in securities listed in the Saudi capital market for less than three years which comply to Sharia’ rules. The fund also aim to achieve returns that exceed the benchmark index growth (IdealRating Saudi IPO Index). The fund will not distribute any dividends to unitholders and dividends will be re-invested in fund.

| Fund Name | Mulkia IPO Fund |

| SHORT NAME | Mulkia IPO |

| FUND OBJECTIVES | Income & Growth |

| FUND POLICY | The Fund invests in the Initial Shares and Shares of newly listed companies in the Saudi Stock Exchange and is in compliance with Shariah Rules. The Fund Manager exercises voting rights according to the following voting policy https://www.mulkia.com.sa/wp-content/uploads/2019/04/Voting-Policy-IPO.pdf |

| FUND MANAGER | Mulkia Investment Company |

| FUND MANAGER INVESTMENT | 0 |

| AMOUNT INVESTED IN THE FUND BY THE FUND MANAGER | 0 |

| BUSINESS DAYS | business day from Sunday to Thursday with the exception of public holidays for the KSA |

| FUND CATEGORY | Equity Funds – Local |

| FUND DETAILED OBJECTIVE | Capital development on the medium to long term, as the fund aims to achieve a return higher than the growth rate of Benchmark. |

| BASE CURRENCY | Saudi Riyals |

| INCEPTION DATE | 2014/08/12 |

| INCEPTION PRICE | 10 |

| FUND SUB CATEGORY | Shari’ah Compliant |

| FUND BENCHMARK | Ideal Ratings |

| FUND TYPE | Open |

| RISK CATEGORY | High |

| FUND CODE | 137001 |

| Subscription Fees | 1.5% of subscription amount – deducted from subscription amount directly. vat is not including |

| Management Fees | 1.5% yearly of Fund’s Net Asset Valuation – calculated Daily and paid Quarterly. vat is not including |

| Custody Fees | 0.06% yearly of Fund’s Net Asset Valuation and a minimum of SR 60,000 per annum – calculated Daily and paid monthly |

| Redemption Fees | None |

| Auditor Fees | SAR 30,000 Per Annum – calculated daily and Paid every six months. vat is not including |

| Fund Financing Expense | Depends on the market price |

| CMA Review Fees | SAR 7,500 Per Annum – Paid upon demand and calculated daily |

| Tadawul Fees | SAR 5,000 Per Annum – Paid upon demand and calculated daily. vat is not including |

| Fund’s Board Remunerations | SAR 5,000 per meeting attendance for each independent member with a ceilling of SAR 30,000 Per Annum – calculated daily and paid after meetings directly |

| Sharia Committee Remunerations | SAR 43,000 Per Annum – calculated daily and Paid every six months |

| Benchmark Index Fees | SAR 26,250 Per Annum – Paid beginning of fiscal year and calculated daily |

| # | File Name | View |

|---|---|---|

| 1 | Mulkia IPO Fund T&C 2018 | View |

| # | Report Name | View |

|---|---|---|

| 19 | Annual Report - 2019 | view |

| 18 | IPO fund Semi-Annual report for the second half of 2019 | view |

| 17 | ipo short report 2019 | view |

| 16 | Quarterly IPO Report - Q4 2019 | view |

| 15 | Quarterly IPO Report - Q3 2019 | view |

| 14 | IPO Report -H1 2019 | View |

| 13 | Quarterly IPO Report - Q2 2019 | view |

| 12 | Quarterly IPO Report - Q1 2019 | view |

| 11 | Annual Report - 2018 | view |

| 10 | Quaterly IPO Report - Q4 2018 | View |

| 9 | Quaterly IPO Report - Q3 2018 | view |

| 8 | Quaterly IPO Report - Q2 2018 | View |

| 7 | Quaterly IPO Report - Q1 2018 | View |

| 6 | Yearly Report 2017 | View |

| 5 | Quaterly IPO Report - Q3 2017 | View |

| 4 | Quaterly IPO Report - Q2 2017 | View |

| 3 | Quaterly IPO Report -H1 2017 | View |

| 2 | Quaterly IPO Report -H1 2018 | View |

| 1 | Quaterly IPO Report - Q4 2017 | View |